About Pay2speed

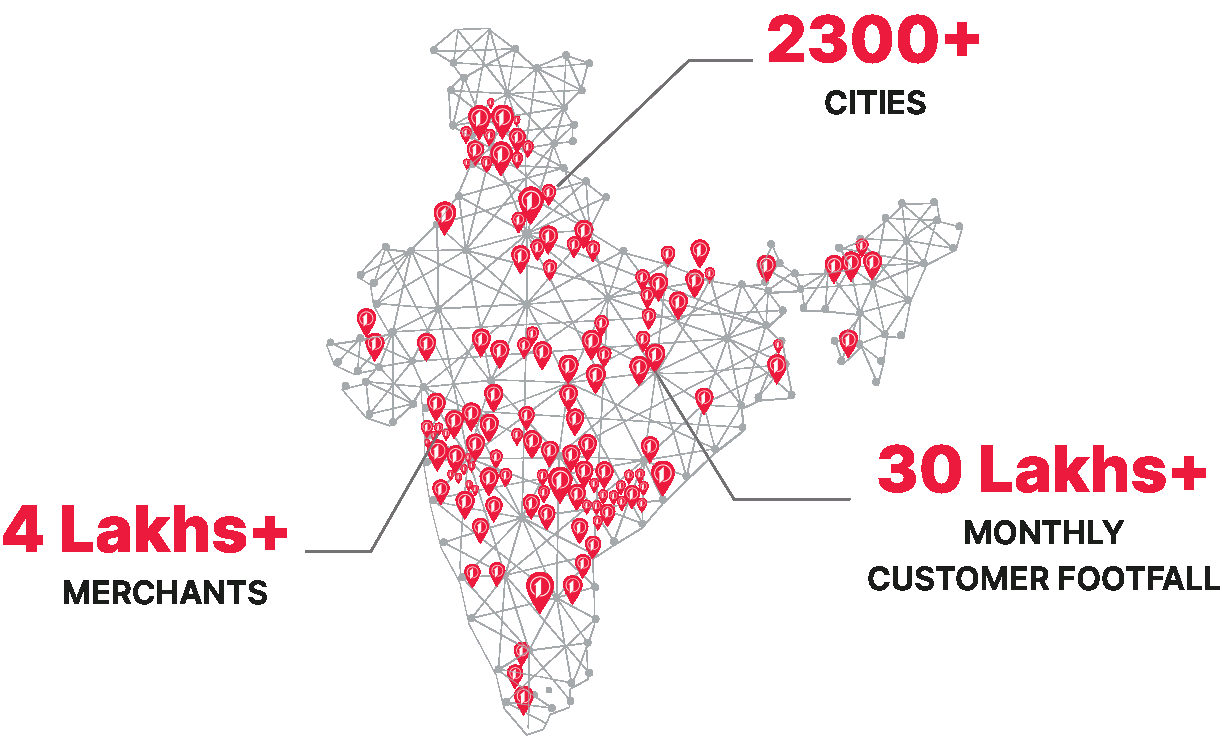

Our Presence

Pay2speed provides an easy to use technology via an app or web portal which gives merchants access to new products and services in the market, provide technology to manage their store and become a digital payment and banking point

We are trusted by more than 9 lakhs merchants in more than 2900 Cities, these merchants today are able to optimally utilise their resources by being a part of the Pay2speed platform

Who we are?

We Are Your Family Member

Pay2speed is an initiative from Rudra group of companies. It started its operations in the year 2016 and has made its presence known in 720+ districts and 28 states across India. Pay2speed was started with the idea of bridging the gap between the untouched market segments and the service providers. Using Pay2speed intelligent transaction processing platform, the consumer can initiate transactions by visiting the retail touch points by paying digitally or by cash. Over 3 Lakhs+ transactions are done using this platform every day through our 9 Lakhs+ retail touch points, serving 5 Crore+ consumers spread across the nation.

We at Pay2speed believe in the business philosophy of “Making Life Simple” and provide every possible opportunity to our retailers and distributors to start their business with minimum investment and maximum return. Under this platform, Pay2speed offers a plethora of utility services to its consumers in terms of AEPS, Domestic Money Transfer, Mobile and DTH Recharge, Rail Ticketing, Air Ticketing, Bus Ticketing and Utility Bill Payments, CMS (Cash Management Service), Digi Gold, Insurance, API etc.

At Pay2speed, we offer a wide range of services to meet your daily needs. From digital transactions with AEPS to domestic money transfers, mobile and DTH recharges, and convenient travel booking services, we’ve got you covered. We also provide utility bill payments, cash management through our CMS, and insurance options to protect your assets. Explore the world with our travel services or get financial assistance with our gold and business loans. At Pay2speed, we’re dedicated to simplifying your life with our diverse array of services.

Pay2speed was built on three fundamental ideas

Pay2speed aims to contribute to accelerating the digital revolution, especially in rural areas, given the extensive market which rests there. One of the unique features of digital payments has been their ability to access the areas that even banks could not access. Though Pay2speed digitalisation campaign is yet to reach its optimum potential, our motto is to encourage smooth and easy digital transactions in remote parts of the country.

Easy And Fast Our Portal Working is very easy and fast.Do safe and secure transactions 24x7.

Anytime we are ready for Customer support

It is very easy and easy to use, and user friendly also and security

Our Team

We are not only one big team, But we are also one big family.

Meet Our Team

Teamwork makes the dream work

Vidya Nivas Tiwari

Founder & Director

Chandani Tiwari

Co-Founder & C.E.O.

Shoumya Singh

Chief Financial Officer

Shivansh Pathak

Chief Technical Officer

Shrijesh Shiv

Chief Marketing Officer

Firoj Ahmed

Chief Accounting Officer

Rupesh Shrivastwa

Chief Legal Officer

Anurag Yadav

Chief Oprating Officer

India's Best Leading Fintech Company

Pay2speed Advantage

Upgrade your business with the leader in branchless banking

- Instant and easy onboarding

- Zero additional investment, no working capital requirement

- Time tested systems, with industry best success rates

- Simple, secure, easy to use App

- Available in 10+ languages

- Relationship managers to support your business at all times

- Training and certification

- Safety and Security Promise of PayNearby

Our Partners

50+ Companies Have Partnered With Pay2speed

India’s Largest Distribution as-a-service Platform.

Connect with us :

Get update notification :

Services

- AEPS

- Micro ATM

- Domestic Money Transfer

- BBPS

- POS/ VoiceBox

- UPI QR

- Insurance

- Cash Management Service

Legal

- Disclaimer

- Annual Report 22-23

- Annual Report 23-24

- Privacy

- FAQs

- Loan Grievance Policy

- Portfolio Disclosure